- Learning

- Canadian Securities Course (CSC®)

- Investment Funds in Canada (IFC)

- Conduct and Practices Handbook Course (CPH®)

- Wealth Management Essentials (WME®)

- Derivatives Fundamentals and Options Licensing Course (DFOL)

- Investment Management Techniques (IMT®)

- Advanced Investment Strategies (AIS)

- Portfolio Management Techniques (PMT®)

- Partners, Directors and Senior Officers Course (PDO)

- Branch Compliance Officer's Course (BCO)

- Investment Dealer Supervisors Course (IDSC)

- WME Course For Financial Planners (WME-FP)

- Chief Compliance Officers Qualifying Examination (CCO)

- Derivatives Fundamentals Course (DFC)

- Trader Training Course (TTC)

- Options Supervisors Course (OPSC)

- Futures Licensing Course (FLC)

- WME Course For Investment Managers (WME-IM)

- Options Licensing Course (OLC)

- New Entrants Course (NEC)

- WME Course For Wealth Managers (WME-WM)

- Chief Financial Officers Qualifying Examination (CFO)

- Canadian Commodity Supervisors Exam (CCSE)

- Licensing & Regulatory Organizations

- Certificate in Financial Services Advice (CFSA)

- Certificate in Advanced Financial Advice (CAFA)

- Certificate in Advanced Investment Advice

- Certificate in Small Business Banking (CSBB)

- Certificate in Technical Analysis (CITA)

- Certificate in Investment Dealer Compliance (CIDC)

- Certificate in Derivatives Market Strategies (CDMS)

- Certificate in Retirement Strategy (CRS)

- Certificate in Estate Planning & Trust Strategy (CETS)

- Certificate in Commercial Credit (CICC)

- Certificate in Personal Banking (CPB)

- Certificate In Bank Management (CBM)

- Micro-Certificate in Alternative Investments (MCAI)

- Micro-Certificate in Applied Behavioural Finance (MCABF)

- View All Certificate Pathways

- Fellow of CSI (FCSI®)

- Personal Financial Planner (PFP®)

- Chartered Investment Manager (CIM®)

- Certified International Wealth Manager (CIWM)

- Designated Financial Services Advisor (DFSA™)

- Estate & Trust Professional (MTI®)

- CSI Path to Certified Financial Planner (CFP®)

- CSI Path to Qualified Associate Financial Planner (QAFP™)

- CSI Path to Financial Planning Program – Quebec (IPF)

- View All Designation Pathways

- Personal Financial Services Advice (PFSA)

- Financial Planning I (FP I)

- Financial Planning II (FP II)

- Financial Planning Supplement (FPSU)

- Investment Advisors Training Program (IATP)

- Financial Planning Integration Course (FPIC)

- Applied Financial Planning Certification Exam (AFP)

- CIWM Certification Examination

- Life Licence Qualification Program Insurance Course (LLQP)

- View All Courses

Featured Product

Conquer the Financial Services Landscape with the CSC®

Receive a 10% discount on your preferred version of the CSC® until April 30

Featured Product

CFSA: Preferred Credential for Personal Bankers

Better understand your clients' unique financial needs and goals to build positive client relationships with the CFSA.

Featured Product

PFP® Approved Under FSRA Title Regulation

FSRA has approved the Personal Financial Planner (PFP®) designation for Financial Planner title use in Ontario.

Featured Product

Explore Multiple Career Paths

Explore different roles and opportunities available in the financial services industry and view the recommended courses and credentials.

Featured Product

Meet CE Requirements Quickly and Easily

Explore continuing education courses and meet your requirements for CSI, CIRO, CSF and other professional associations or certifications.

Featured Product

Get 10% off the PFSA course until February 28!

Get started with the Personal Financial Services Advice (PFSA) course to enhance your soft skills and build profitable client relationships.

Featured Product

Explore Multiple Career Paths

Explore different roles and opportunities available in the financial services industry and view the recommended courses and credentials.

- Exams & Administration

Featured Product

Canadian Securities Course CSC®

Featured Product

Preparing to Take Your CSI Exam?

Write your exam through Remote Proctoring from any location (including your home) or In-Person at one of our test centres.

- Credentials

Featured Product

Credentials That Matter

Meet the highest standards of experience & education for financial professionals with CSI certificates, designations & fellowship.

Featured Product

FCSI® – The Highest Honour in Financial Services

Join an elite group of leaders in financial services and make a meaningful impact for your clients with the Fellow of CSI (FCSI®).

Featured Product

PFP® – The Premier Credential for Financial Planners

Master financial planning skills with the ISO and FSRA-certified Personal Financial Planner (PFP®) designation.

Featured Product

CIM® – The Recognized Credential for Investment Managers

Learn how to manage money on a discretionary basis for sophisticated clients with Chartered Investment Manager (CIM®).

Featured Product

CIWM – The Leading Credential for Wealth Managers

Establish your credibility to address the unique needs of affluent clients with Certified International Wealth Manager (CIWM).

Featured Product

DFSA - The leading credential for financial advice in Canada

Featured Product

MTI® – Prestigious Credential for Trust & Wealth Managers

Gain expertise in the regulations and tax implications that are crucial for management and transfer of wealth with MTI®.

- Corporate Solutions

Featured Product

Find Qualified Candidates Faster

Talent Pro connects organizations with qualified and licensed candidates to fill active opportunities in the banking industry.

Featured Product

Find Qualified Candidates Faster

Talent Pro connects organizations with qualified and licensed candidates to fill active opportunities in the banking industry.

- Insights

Featured Product

Webinars to Boost Financial Literacy

During Financial Literacy Month we aim to help Canadians understand their finances better & navigate the changing economic landscape.

Featured Product

Become a Speaker With CSI

CSI Podium offers designation holders opportunities to speak on topics to benefit their clients, colleagues, and the investing public via webinars.

- About

Featured Product

PFP® Approved Under FSRA Title Regulation

FSRA has approved the Personal Financial Planner (PFP®) designation for Financial Planner title use in Ontario.

Featured Product

PFP® Approved Under FSRA Title Regulation

FSRA has approved the Personal Financial Planner (PFP®) designation for Financial Planner title use in Ontario.

Designated Financial Services Advisor (DFSATM)

Home > Learning > Designation Pathways > Designated Financial Services Advisor (DFSATM)

What is the Designated Financial Services Advisor (DFSATM) designation?

The Designated Financial Services Advisor (DFSATM) designation is a leading credential for financial advice in Canada. Used by Canada’s largest financial institutions, it ensures that financial advisors have the knowledge and skills to provide appropriate advice to address a client’s financial situation.

What are the requirements to earn the Designated Financial Services Advisor (DFSATM) designation?

The requirements to earn the Designated Financial Services Advisor (DFSATM) designation are defined by the DFSA Competency Profile. This profile is aligned with industry best practices and provides the knowledge and skills applied by advisors. It also drives the pre-requisite requirements, education and ongoing maintenance requirements.

To be eligible to earn the DFSA designation, candidates must complete Investment Funds in Canada (IFC) and agree to:

- Complete one of the educational paths;

- Complete application form and attestation;

- Abide by the Code of Ethics, the Ethical Misconduct Process and the Trademark License Agreement; and

- Commit to ongoing continuing education once the designation education path has been completed.

Note: Completion of the Canadian Securities Course (CSC®) grants an exemption to the IFC.

If you have any questions regarding eligibility, please contact your employer directly.

What is the path to the Designated Financial Services Advisor (DFSATM) designation?

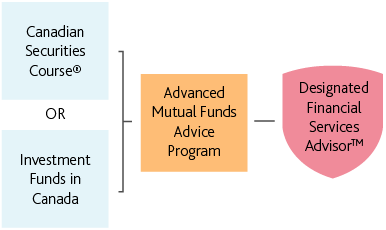

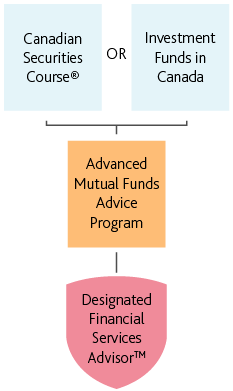

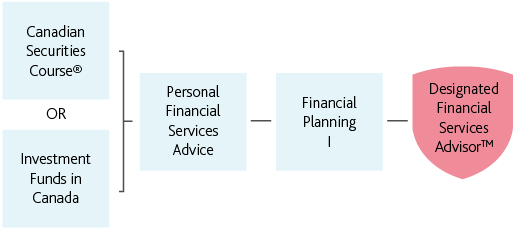

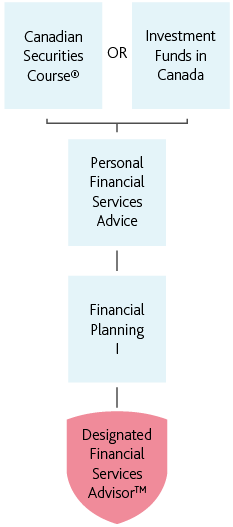

CSI offers three educational paths to achieve the DFSATM designation. The DFSATM requires applicants to complete an approved education path within 2 years of being granted the designation.

Course Pathway for Banking and Credit Union Employees1

1 This is a CIRO pathway.

Course Pathway for Investment Advisors2

Mobile_DFSA – Pathway for Investment Advisors

2 This is a CIRO pathway.

Course Pathway for Independent Mutual Fund Advisors3