Certificate in Financial Services Advice (CFSA)

What is the Certificate in Financial Services Advice?

The Certificate in Financial Services Advice is designed to support your career progression in any financial advisory role. This certificate also provides foundational knowledge for any financial services professional in any position, helping you better understand the front-line of client-facing financial advice.

What skills will you develop?

- Synthesize customer information to provide quality advice to clients

- Build trustworthy and credible client relationships

- Identify strategies for satisfying clients with varying needs, goals and objectives

- Evaluate the merits of different financial tools to create value for clients

- Assess the current financial climate in relation to client risk tolerance

- Build positive and profitable client relationships through communication, trust and credibility

- Establish a loyal client base through adherence to superior performance and service standards

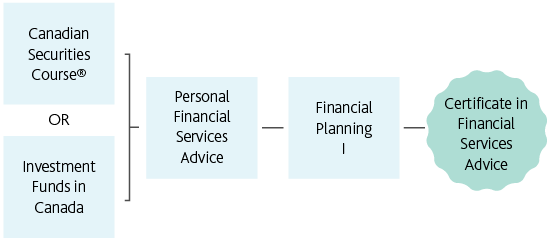

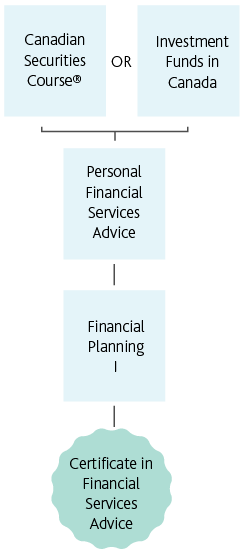

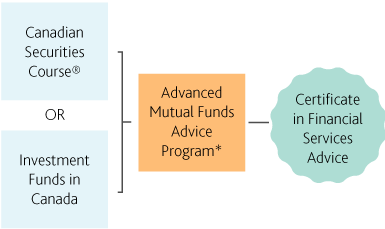

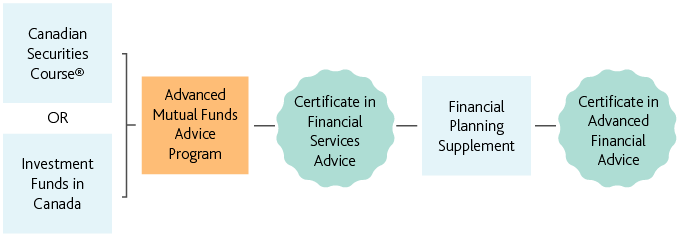

What are the paths to the Certificate in Financial Services Advice?

This certificate is also on the path to the Personal Financial Planner (PFP®) designation.

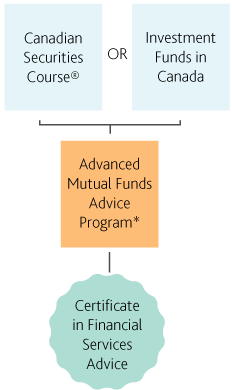

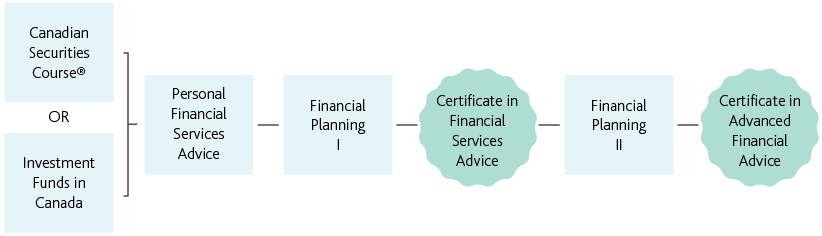

CSI Route for Bankers

CSI Route for Mutual Fund Representatives (CIRO)

Who should enrol?

Individuals who are working in the financial services industry seeking to grow their knowledge and take their careers to the next level.

Certificate in Advanced Financial Advice (CAFA)

What is the Certificate in Advanced Financial Advice?

The Certificate in Advanced Financial Advice is tailored to support your career progression in many financial advisory roles. This certificate provides advanced knowledge for financial services professionals in client-facing advisory roles. You will gain a deeper knowledge of advanced financial advice and financial planning. The Certificate in Advanced Financial Advice is an essential step toward becoming a Personal Financial Planner (PFP®).

What skills will you develop?

- Build trustworthy and credible client relationships

- Identify strategies for satisfying clients with varying needs, goals and objectives

- Explain the importance of the financial planning process to clients

- Explain the potential impact of life events, such as starting a family, on the financial planning process and your client's goals and objectives

- Identify client's financial goals and constraints to develop and customize their financial plan

- Develop a savings plan emphasizing the importance of outlining net worth, cash flow, and saving strategies

- Demonstrate the importance of asset allocation and risk management when recommending investment solutions for clients

- Estimate retirement income needs and determine if those needs can be met with the client’s available resources

- Explain the benefits of estate planning techniques to individuals, families and small business owners

- Explain the potential impact of life events, such as divorce on the estate planning process

- Identify opportunities to refer clients to appropriate experts for specialized advice

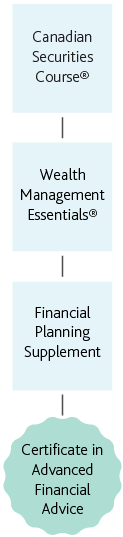

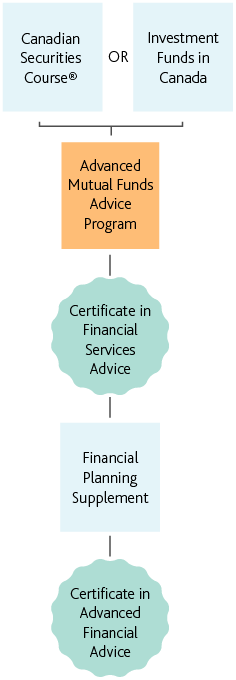

What is the path to the Certificate in Advanced Financial Advice?

This certificate is also on the path to the Personal Financial Planner (PFP®) designation. Please note that only students who have completed one of the educational paths after July 1, 2019, will be granted the Certificate in Advanced Financial Advice.

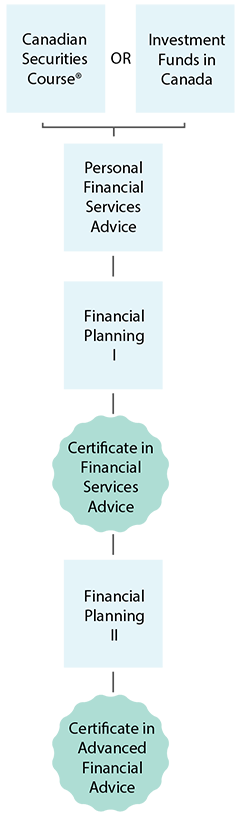

CSI Route for Bankers

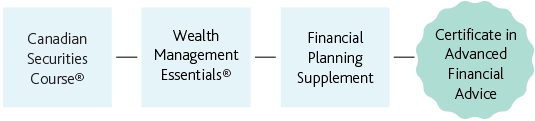

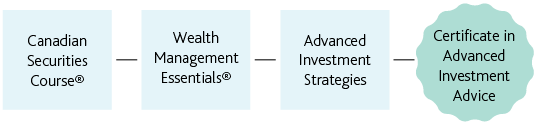

CSI Route for Investment Advisors (CIRO)

CSI Route for Mutual Fund Representatives (CIRO)

Certificate in Advanced Investment Advice (CAIA)

What is the Certificate in Advanced Investment Advice?

The Certificate in Advanced Investment Advice provides investment advisors with advanced and practical advisory knowledge—enabling them to stand out in a highly competitive financial industry. This certificate also serves as an interim certificate that puts you on the path to the Certified International Wealth Manager (CIWM) designation for high-net-worth wealth management and the Chartered Investment Manager (CIM®) designation for discretionary investment management.

What skills will you develop?

- Share advanced insights with your retail clients and help them make better investment decisions

- Use behavioural finance techniques to identify your clients' risk tolerance

- Use special techniques to manage your client's portfolio risk

- Identify advantages, disadvantages and methods of international investing

- Evaluate the merits of traditional and non-traditional investment products

- Evaluate the array of non-traditional investment products and portfolio solutions available in today's retail market

- Evaluate investor personality types through behavioural finance techniques

- Managing your clients' investment risk

Expert knowledge in these areas will enable you to offer advanced advice to your retail clients and stand out in a highly competitive industry.

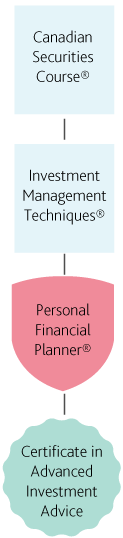

What is the path to the Certificate in Advanced Investment Advice?

This certificate is also on the path to the Chartered Investment Manager (CIM®) designation.

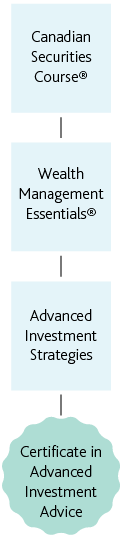

Option 1

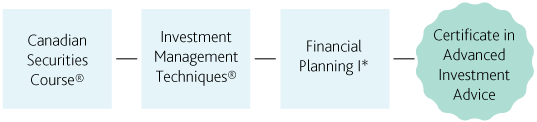

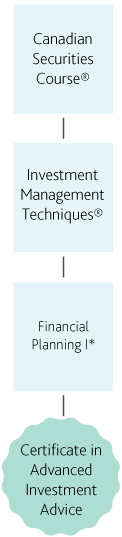

Option 2

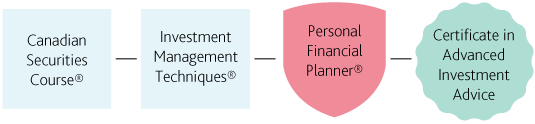

Option 3

Important

In addition to the Investment Management Techniques (IMT®) course, individuals seeking the Certificate in Advanced Investment Advice must complete one of the following: Financial Planning I, Financial Planning II, the AMFA Certification Exam, the Personal Financial Planner (PFP®) designation, the Certified Financial Planner (CFP®) designation or the Chartered Life Underwriter (CLU®) designation. Please note these courses and designations are NOT required for the CIM® designation, only for the Certificate in Advanced Investment Advice. For more information on work experience requirements, click here.

The Certificate in Advanced Investment Advice is not required to attain the CIM® designation.

External Designation Recognitions are subject to CSI’s External Designation Recognition policy and fee.

Who should enrol?

Registered advisors working in a securities firm (CIRO platform) in an investment advisory capacity who are looking to enhance their knowledge to better serve their retail clients.

Certificate in Small Business Banking (CSBB)

What is the Certificate in Small Business Banking?

With a Moody's Certificate in Small Business Banking, you can foster stronger partnerships with the business owners you serve by fully understanding the unique challenges they face, helping them to build their businesses and realize success.

What skills will you develop?

- Gain 'real world' understanding of how small business owners operate their day-to-day businesses

- Effectively apply knowledge of the small business industry

- Gain confidence in analyzing a small business and create proactive solutions

- Determine the financial status of a small business

- Proactively develop internal and external relationships

- Uncover the needs, goals, and objectives of a small business

- Mitigate risk to minimize negative outcomes

- Provide a high level of client service and develop client loyalty

- Understand real world applications when using new skills

- Grow, retain, and attract small business clients

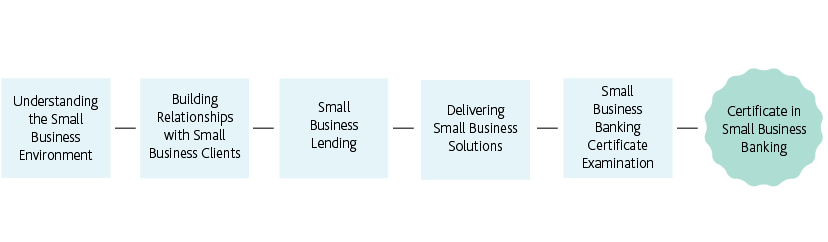

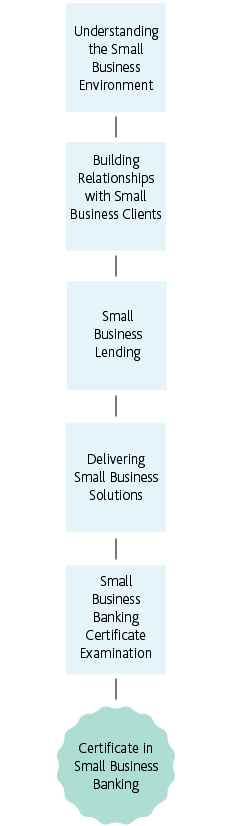

What is the path to the Certificate in Small Business Banking?

*Please note that students must complete prior four courses and enrol in the Certificate in Small Business Banking Program before enroling in the examination.

Who should enrol?

The Certificate in Small Business Banking is designed for students who are already in or interested in moving into the small business arena. This includes people who are currently small business advisors, small business account managers or branch managers of banks. This course is also relevant for people working in mutual funds, personal lending, or as mortgage specialists, risk managers or underwriters.

Certificate in Technical Analysis (CITA)

What is the Certificate in Technical Analysis?

The Certificate in Technical Analysis provides validation that you have completed a rigorous program that requires a demonstration of knowledge and skills in the areas of capital markets and technical analysis. Completing this program will equip you to appreciate and apply analytical techniques from both the worlds of traditional fundamental analysis and technical analysis.

What skills will you develop?

- In-depth understanding of capital markets, the benefits and risks of various investment products

- Learn fundamental analytical tools such as financial ratios and the dividend discount model

- Understand various types of financial instruments and their benefits and risks

- Compare and contrast fundamental and technical analysis

- Distinguish between economic, industry and company analysis

- Calculate and interpret the intrinsic value of a stock

- Construct and interpret bar, line, candlestick and point and figure charts

- Identify support and resistance levels and trend lines

- Read and interpret continuation and reversal chart patterns

- Use trend-following and momentum statistical market indicators

- Understand the relationship between various types of markets (commodities, fixed income, foreign exchange and equity)

- Understand the benefits and detriments of high frequency trading

- Implement money market rules

- Gain knowledge of cycle and Intermarket analysis

- Formulate a trading plan

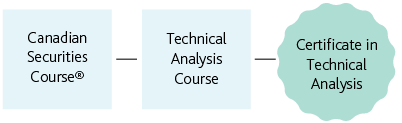

What is the path to the Certificate in Technical Analysis?

Who should enrol?

- Investment advisors and representatives who want to distinguish themselves with knowledge of both fundamental and technical analysis.

- Individuals who wish to move into or progress in professional trading roles on either the buy or sell side. This certificate is on the path to the Certificate in Equity Trading and Sales and the Certificate in Fixed Income Trading and Sales.

- Self-directed investors who just want to sharpen their trading skills.

- Junior analysts and portfolio managers who want to learn more about technical analysis and how it can complement fundamental analysis.

Certificate in Investment Dealer Compliance (CIDC)

What is the Certificate in Investment Dealer Compliance?

The Certificate in Investment Dealer Compliance is the only program of its kind in Canada tailored to provide specialized knowledge of compliance issues, actions, and impacts to business units within securities firms. This industry-recognized program applies to both retail and institutional dealer settings.

What skills will you develop?

- Gain dealer compliance skills applicable to both retail and institutional settings

- Demonstrate the ability to apply compliance knowledge gained through courses within the Certificate in Investment Dealer Compliance

- Have increased mobility within any securities firm

- Gain increased compliance knowledge to maintain competitive edge

- Gain a recognized and transferable credential

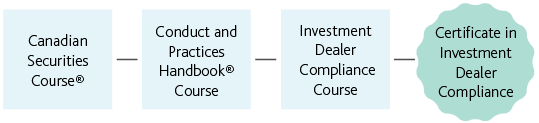

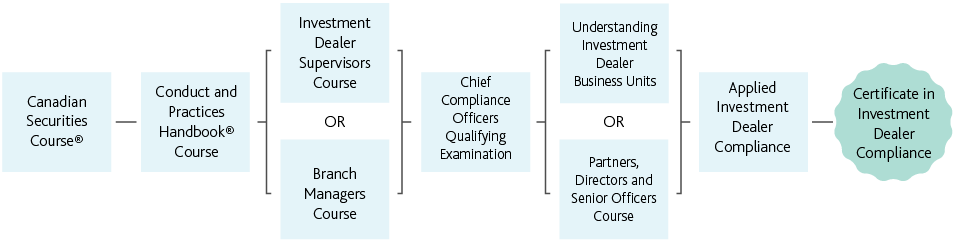

What is the path to the Certificate in Investment Dealer Compliance?

Option 1

Option 2

Who should enrol?

The Certificate in Investment Dealer Compliance is designed for individuals who want to pursue or advance their compliance career within an investment dealer firm. These include front or back-office staff who wish to move into a compliance position, compliance analysts, risk managers, retail account supervisors, trade desk supervisors, branch managers, or compliance officers working within the retail branch of a securities firm or a head-office compliance department at a securities firm.

Certificate in Derivatives Market Strategies (CDMS)

What is the Certificate in Derivatives Market Strategies?

The Certification in Derivatives Market Strategies will help you understand the complex world of derivatives. You will gain specialized knowledge and skills in the advanced concepts and applications of derivative investments—including options, futures, and swaps. You will also learn how to use derivatives to manage interest rate, equity, currency, and commodity risk.

What skills will you develop?

- Develop an in-depth understanding of options, futures and swaps

- Gain a deep understanding of various underlying financial and commodity markets

- Understanding the various applications of derivatives including managing risk, trading and product construction

- Competence in the various trading techniques using options and futures

- Deep understanding of the supply and demand fundamentals of various financial and commodity markets

- Distinguish yourself as a derivatives specialist

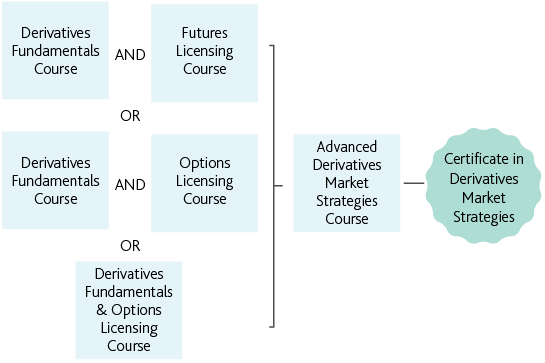

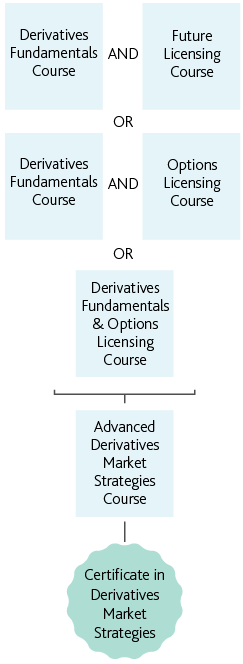

What is the path to the Certificate in Derivatives Market Strategies?

Who should enrol?

Individuals who’re in:

- Investment advisory with a focus on derivatives trading

- Institutional sales and trading

- Risk management in both financial and non-financial corporations

- Conventional and alternative portfolio management

- Structured product development

- Equity and fixed income research

- Treasury

Licensing and Registration

- Successful completion of the Derivatives Fundamentals and Options Licensing (DFOL) course allows you to apply for licensing to sell exchange-traded options to the public.

- Successful completion of the Derivatives Fundamentals Course (DFC) and the Futures Licensing Course (FLC) allows you to apply for licensing to sell futures contracts to the public.

Certificate in Retirement Strategy (CRS)

What is the Certificate in Retirement Strategy?

The Certificate in Retirement Strategy provides validation that you have the knowledge and skills to help your clients determine and meet their retirement planning goals. As baby boomers swell the ranks of the near-retired and retired, this certificate will enable you to distinguish yourself as an expert specifically qualified to address this burgeoning market and gain an edge over your peers.

What skills will you develop?

- Deal with the special considerations faced by aging clients

- Recommend tactics and financial products to convert assets into income to help support a client's desired retirement lifestyle while minimizing the risk of outliving one's wealth

- Identify and recommend strategies to help minimize risks to a client's wealth

- Construct goal-based portfolios based on asset allocation and asset location strategies

- Recommend strategies to minimize retirees taxes and protect wealth

- Determine the efficacy of gifting to family members

- Determine sustainable withdrawal rates to minimize longevity risk

- In-depth knowledge in wealth conversion and sustainable withdrawal rates

- Build a strong foundation in tax strategies and structures

- Increased credibility as a retirement expert

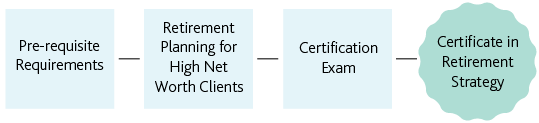

What is the path to the Certificate in Retirement Strategy?

This certificate is also on the path to the CIWM designation.

With the restructuring of the CIWM designation, the pathway for CRS has changed. CSI will continue to recognize the historical pathway to CRS for those enrolled in the Advanced Retirement Management Strategies Course prior to May 8, 2019, and completing the course within their enrolment period. Since the launch of Retirement Planning for High Net Worth Clients on May 8, 2019, we are recognizing the new pathway.

New Pathway

Historical Pathway

Pre-requisite Requirements

Candidates must hold ANY of the following Financial Planning designations (PFP®, CFP®, Pl. F.) or the Wealth Management Essentials (WME®) Course or Foundations of Financial Planning (FOFP) Course. External Designation Recognitions are subject to CSI’s External Designation Recognition policy and fee.

View the Retirement Planning for High Net Worth Clients Course page for more information on the CRS Certification Exam.

Who Should Enrol?

The Certificate in Retirement Strategy is designed for individuals with experience in the financial services advisory professions such as investment advisors, financial advisors, financial planners and life insurance specialists, working within a securities firm, bank, or financial planning organization. These individuals aspire to gain a credential to reflect their specialization in retirement strategy advisory services for their clients.

Certificate in Estate Planning & Trust Strategy (CETS)

What is the Certificate in Estate Planning and Trust Strategy?

The Certificate in Estate Planning and Trust Strategy is specifically designed to support your career specialization as a wealth manager and attest that you have the skills and knowledge that reflect today's estate planning and trust industry practices. You will gain a deeper knowledge of estate planning, sucession planning, trust process, and tax strategies and structures. Completing this program will also help you build practical skills that can be immediately applied to current client situations.

What skills will you develop?

- Advise on the different types of wealth that may be transferred

- Deepen relationships with high-net-worth clients and become a partner in planning

- Consult on taxation and estate planning strategies

- Advise on the roles of Wills, Powers of Attorney, Living Wills and Probate in a wealth transfer plan

- Provide succession planning for small business and identify the appropriate solution for each unique situation

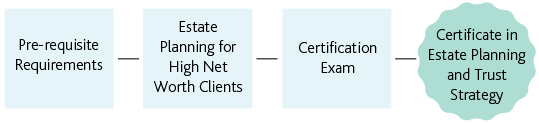

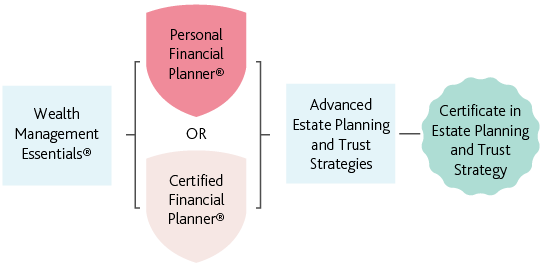

What is the path to the Certificate in Estate Planning and Trust Strategy?

This certificate is also on the path to the CIWM designation.

With the restructuring of the CIWM designation, the pathway for CETS has changed. CSI will continue to recognize the historical pathway to CETS for those enrolled in the Advanced Estate Planning and Trust Strategies Course prior to May 8, 2019, and completing the course within their enrolment period. Since the launch of the Estate Planning for High Net Worth Clients course on May 8, 2019, we are recognizing the new pathway.

New Pathway

Historical Pathway

Pre-requisite Requirements

Candidates must hold ANY of the following Financial Planning designations (PFP®, CFP®, Pl. F.) or the Wealth Management Essentials (WME®) Course or Foundations of Financial Planning (FOFP) Course.

External Designation Recognitions are subject to CSI’s External Designation Recognition policy and fee.

View the Estate Planning for High Net Worth Clients Course page for more information on the CETS Certification Exam.

Who should enrol?

The Certificate in Estate Planning and Trust Strategy is designed for individuals with experience in the financial service advisory professions such as investment advisors, financial advisors, financial planners and life insurance specialists, working within a securities firm, bank, or a financial planning organization. These individuals must have completed a recognized financial planning course or designation and now aspire to learn an additional level of specialization in estate planning and trusts strategies.

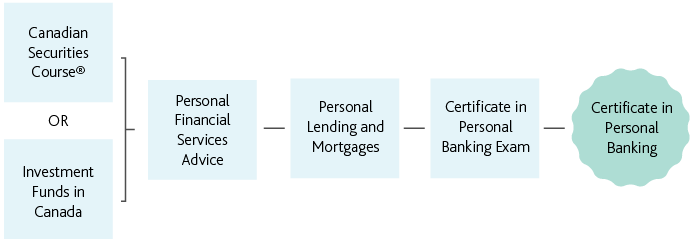

Certificate in Personal Banking (CPB)

What is the Certificate in Personal Banking?

The Certificate in Personal Banking provides comprehensive knowledge and skills in personal banking, including mutual fund and investment advice knowledge and capabilities, relationship building skills, understanding of consumer lending and ability to mitigate risk. It also ensures you meet the professional standards to be effective and credible to serve your clients as a trusted financial advisor.

What skills will you develop?

- In-depth understanding of investment practices

- Synthesize customer information to provide quality advice

- Identify strategies for satisfying clients investing, borrowing needs, goals and objectives

- Build positive and profitable relationships through communication, trust and credibility

- Establish a loyal client base through superior performance and service

- Hone relationship selling skills

- Identify and actively minimize risk

What is the path to the Certificate in Personal Banking?

External Designation Recognitions are subject to CSI’s External Designation Recognition policy and fee.

Who should enrol?

- Tellers/customer service/financial service representatives who want to advance their careers and assume larger responsibilities

- Retail banking professionals

- Newly promoted individuals entering their first sales roles

- Retail banking advisors seeking to strengthen their knowledge of lending and mortgages

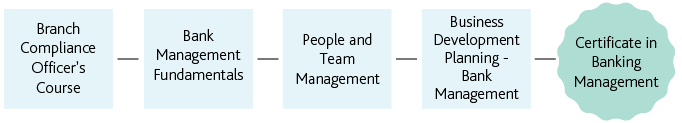

Certificate In Bank Management (CBM)

What is the Certificate in Banking Management?

The Certificate in Banking Management equips the bank manager to be able to guide and lead staff, develop and meet sales initiatives and, implement corporate and regulatory requirements. Using knowledge of the industry and ethical and moral behavior, a bank manager will have the knowledge to successfully deal with and carry out day-to-day interactions with clients and business associates. You will develop a business owner mindset that will equip you with the right skills to think critically, manage risk, and build and maintain a highly-engaged team.

What skills will you develop?

- Sharper business owner's mindset to develop business opportunities and increase revenue

- Learn management techniques to engage and develop employees

- Ability to implement and maintain corporate and regulatory requirements

- Gain knowledge and tools to create and implement a sound business development plan to achieve maximum sales volume.

What is the path to the Certificate in Banking Management?